Page 27 - Spanish Insight - October 2019

P. 27

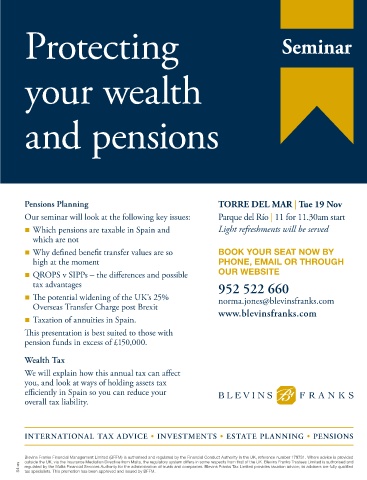

Protecting Seminar

your wealth

and pensions

Pensions Planning TORRE DEL MAR | Tue 19 Nov

Our seminar will look at the following key issues: Parque del Río | 11 for 11.30am start

Which pensions are taxable in Spain and Light refreshments will be served

which are not

Why defined benefit transfer values are so BOOK YOUR SEAT NOW BY

high at the moment PHONE, EMAIL OR THROUGH

QROPS v SIPPs – the differences and possible OUR WEBSITE

tax advantages

952 522 660

The potential widening of the UK’s 25% norma.jones@blevinsfranks.com

Overseas Transfer Charge post Brexit

Taxation of annuities in Spain. www.blevinsfranks.com

This presentation is best suited to those with

pension funds in excess of £150,000.

Wealth Tax

We will explain how this annual tax can affect

you, and look at ways of holding assets tax

efficiently in Spain so you can reduce your

overall tax liability.

INTERNATIONAL TAX ADVICE • INVESTMENTS • ESTATE PLANNING • PENSIONS

Blevins Franks Financial Management Limited (BFFM) is authorised and regulated by the Financial Conduct Authority in the UK, reference number 179731. Where advice is provided

outside the UK, via the Insurance Mediation Directive from Malta, the regulatory system differs in some respects from that of the UK. Blevins Franks Trustees Limited is authorised and

S4-es regulated by the Malta Financial Services Authority for the administration of trusts and companies. Blevins Franks Tax Limited provides taxation advice; its advisers are fully qualified

October 2019 Spanish Insight

27

tax specialists. This promotion has been approved and issued by BFFM.